,

An expense report is an overview that occurs during a specific period of time or a specific job or task. Expense reports can be very extensive, sometimes covering entire departments in the enterprise, or the reports can be personalized and only apply to one employee and one task. In most cases, expense reports are used to record expenses necessary for employees to work outside the normal office environment. In most cases, the expense report is reviewed by the department head and then transferred to accounting.

This article covers:

- Reasons you need to use the Business Expense Report

- Why is an expense report important?

- Contents of the expense report

- Specific examples of expenses that sole proprietors cannot record expenses

- Expense report example

- Expense Management and Reporting Software

Reasons you need to use the Business Expense Report

Expense reports can be a daunting task, but in the end, they serve the company’s best interests in the event of a dispute or financial audit. By submitting these reports regularly, you can ensure that you and your employees set the budget properly to cover the expenses necessary to keep your business financially secure, as well as maintaining company morale and goodwill.

No employee (or employer) will want to use their personal funds to carry out the task that is contracted for a salary. Therefore, keeping and maintaining the expense report leaves all concerned parties in a better financial position than allowing these costs to be borne by the employee or owner instead of the company. (www.sweet-factory.com)

If you are in charge of the business or if you run a small business, expense reports may seem foolish, but then again, it is as important to your company as it is to an employee of a company like Apple or Disney. Tracking where you spend your money to participate in the professional activities of your small company is part of your company’s financial control and should be used when submitting taxes to accurately calculate the amount of money your company has spent throughout the year.

Why is an expense report important?

There are two important reasons for this on the part of the legislator:

- Without an expense report, the employer does not have to pay it.

- An incorrect expense report is a reason for termination without notice.

It is therefore important to always prepare an expense report. It is also necessary to edit these really very precisely. Details on the correct expense report can be specified in the respective collective agreement, in the company agreements, and in the specific employment contract.

Contents of the expense report

The employee who contributes any financial amount must indicate in this report the amount to be paid, as well as the concept. It is very important to ask for some kind of proof of these expenses to verify that it has actually been done. The most used supporting documents are invoices and purchase tickets (simplified invoice ).

To make an employee expense report it is important to know the following information:

Expenses for travel expenses.

They are the expenses of meals in restaurants, hotels, shopping in supermarkets or fast restaurants.

Transportation expenses.

This would include transportation costs by train, plane, taxi, or car rental. It also contains tools and vehicle parking fees.

Accommodation expenses.

They are those that are made when making a trip and have the need to have a stay in a hotel, hostel, or rent an apartment.

Team Meetings Expenses

Expenses of team meetings, such as meals with clients, purchase of some type of material, rental of professional service, etc. Also included are special celebrations, such as promoting a partner in a bar or Christmas dinners or end of the campaign.

Books and Magazines Expenses

Newspapers, magazines, book expenses, etc. are indispensable for getting the business’s information and ideas. Books and magazines purchased to utilize them in business can be expensed as “newspaper book expenses”.

Communication Exapenses

Communication fees such as Internet line usage charges and telephone charges can also be recorded as expenses.

Internet and smartphone usage charges and telephone charges are difficult to delineate from private, but the basic idea is the same as rent and utilities.

Taxes

“Taxes and public dues” refers to taxes and public contributions that correspond to expenses.

“Tax” is a tax paid to the national or local government. Stamp duty, revenue stamp, registration license tax, automobile tax, property tax, etc. are applicable. “Public charges” are public charges and contributions such as grants and membership fees paid to each public organization. Include fees for issuing seal certificates and resident cards, membership fees for chambers of commerce, cooperatives, neighborhood associations, etc.

Marketing Expenses

Advertising expenses are the costs required to sell a product or service. You can think of it as the cost of publishing in media such as newspapers and magazines, and the cost of creating a website for advertising.

Personnel Expenses

Personnel expenses refers to all costs paid to employees as compensation for labor under an employment contract. Employee salaries, bonuses, retirement allowances, etc. are expenses, including housing allowances, etc.

Specific examples of expenses that sole proprietors cannot record expenses

Of the expenses of sole proprietors, various expenses cannot be recorded as expenses. Let’s look at specific examples of expenses that cannot be expensed, including expenses for the business owner himself, such as the training gym and health checkup explained earlier.

Expenses for sole proprietorship’s own life and health care

The sole proprietor’s own salary, pension, insurance premium, etc., cannot be recorded as expenses. Also, even if you go to a training gym to maintain your health, the cost cannot be included in the expenses. The same applies to the cost of the employer’s health checkup and human dock. Employee salaries and medical examinations can be recorded as expenses.

Private shopping and food and drink charges for sole proprietors

Private shopping that is clearly unrelated to the business cannot be an expense. For example, private food and drink, books, transportation, and clothing purchases. However, even if you spend the same amount of money, you can make it an expense to prove that it is necessary for your business. For example, if you purchase a book as reference material for planning a business or creating presentation materials, it will be expensive.

It’s important to note that you shouldn’t count up as an expense even though you’ve spent it on private purposes. It may cause tax trouble at a later date.

Taxes paid by sole proprietors as individuals

Resident tax and income tax paid by sole proprietors cannot be recorded as expenses because they are paid by individuals regardless of the business. However, stamp duty, personal business tax, and property tax, which are apportioned for domestic affairs when working from home (owned house), can be recorded as expenses.

Salary to the family of the sole proprietor

Salaries for families who share a living with sole proprietors cannot be recorded as expenses.

Things that can be depreciated as assets

For equipment such as personal computers purchased for business use that costs less than $10,000, the entire amount can be recorded as expenses for the year. On the other hand, if the amount is $10,000 or more, it must be recorded as a fixed asset and depreciated according to the useful legal life.

In addition, the security deposit paid when moving into a rental property will be returned when you move out. Therefore, it is considered an asset and cannot be recorded as an expense.

Sole proprietor’s suit fee

Suits are generally worn at work, so it seems that they can be included in expenses. However, it is difficult to recognize them as expenses because they can be used as everyday wear. It is indispensable for business, and if there is a clear division that it is used only for business, it may be recorded as an expense.

Food and drink charges for the second party

Eating and drinking charges as entertainment expenses are allowed only up to the first party. Meal expenses after the second party will not be accepted as expenses.

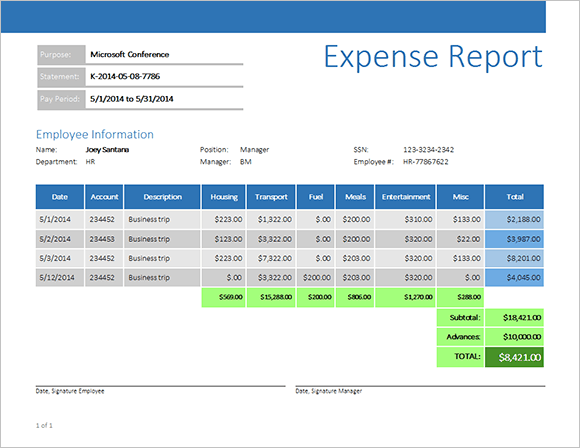

Expense report example

Below we see an example of an expense report, you can download this expense report template at this link.

Expense Management and Reporting Software

Convenient and efficient expense reporting software like Billed offers both a user-friendly experience and enterprise-class features. This powerful accounting software helps employees submit and approve expenses the way they feel comfortable, while also giving them the ability to control and analyze their expenses.

Related Articles: