What Is Cost of Goods Sold (COGS) and How to Calculate It?

The cost of goods sold is calculated by adding purchases for the time to the starting inventory and minus the ending inventory for the period

The Cost of Goods Sold represents all the costs incurred on the product until it is available to consumers at the point of sale. These costs include the purchase value of certain products, processing or conversion costs, and all other costs associated with selling all inventory. From a trading point of view, the cost of the products produced consists of raw material costs, labor costs, and overheads. The inventory cost for unsold goods still in stock must also be added.

The cost of goods can be calculated using the following method:

Cost of Goods Sold = Initial Cost + Net Purchase + Direct Expenses – Final Cost

Calculate the cost of goods sold by the following information:

- Purchase $4,00,000

- Wages $45,000

- Carriage And Freight $7,000

- Opening stock $35,000

- Closing Stock $55,000

Solution:

Cost of Goods Sold = Opening Stock + Purchase + Direct Expenses – Closing Stock

Cost of Goods Sold = 35,000 + 4,00,000 + (45,000 + 7,000) – 55,000 = $4,32,000

This article will also cover:

- What is the cost of goods sold?

- Methods to calculate your COGS

- Components You Must Know Before Calculating the Cost of Production.

- How to calculate COGS at a Trading Company?

- How to calculate COGS at Manufacturing Companies?

- Why is the calculation of the COGS Is Important?

- Cost of Goods Sold Example

- COGS in the financial statements

- What is the difference between the cost of goods sold and purchasing?

- What items are included in the Cost Of Goods Sold?

- Is the Cost Of Goods Sold an asset or a liability?

What is the cost of goods sold?

The COGS, sometimes referred to as ‘cost of sales,’ refers to the cost of products manufactured and sold or bought and resold by the company.

These sales costs represent a business expense and reduce the company’s profit from selling the products, according to The Balance.

For example, suppose a company manufactures an item, sends it to an Amazon store, and sells it online for $25. The cost of the item, which is $18, is deducted from the sale price for profit and tax purposes. The IRS allows for the inclusion of various costs in this calculation.

The cost of goods sold is determined annually, reflecting changes from the beginning to the end of the company’s fiscal year, and is included in the company’s income tax declaration as an expense.

Methods to calculate your COGS.

There are three methods that a business can use to determine the cost of the goods it has sold:

- The first thing that comes is what comes first: also known as the FIFO method (First In, First Out). Through this system, products manufactured or purchased first are also the first to be sold first. During periods of inflation, a company that uses the FIFO method will later sell its more expensive products.

- Last to enter is first to exit: With the LIFO ( Last In, First Out ) method, the most recently added products to inventory are sold first. This means that if the more expensive items are sold early in times of inflation, the result will be a higher COGS.

- Average Cost Method: with this calculating method, the average price of all the products in inventory is used, regardless of the date on which they were purchased. By using the average cost over a specified period, the COGS tends to be consistent, with no significant fluctuations due to large periodic purchases.

Components You Must Know Before Calculating the Cost of Production.

1. Initial Merchandise Inventory

The initial merchandise inventory refers to the quantity of goods available at the beginning of the current period or financial year. This balance is typically recorded in the current trial balance, the company’s initial balance sheet, or the previous annual balance sheet.

2. Final Inventory of Merchandise

The final inventory of merchandise represents the stock of goods available at the end of the period or the end of the current financial year. This inventory balance is commonly found in the company’s adjustment data at the end of the period.

3. Net Purchases

Net purchases encompass all product acquisitions made by the company, including both cash and credit purchases, along with the associated transportation costs. It involves deducting purchase discounts and returns from the total purchases incurred.

How to calculate COGS at a Trading Company?

In a trading company, the calculation of COGS typically involves the following steps:

Calculating Net Sales

Net sales can be calculated using the formula: Net Sales = Sales – (Returns + Sales Discounts). In this calculation, the cost of sales is generally included in the overall expenses and is separate from the calculation of COGS.

Calculating Net Purchases

To calculate net purchases, the formula that can be used is = (Purchase + Freight) – (Returns + Purchase Discount).

Calculating inventory

Inventory can be calculated by adding the initial inventory to the net purchases. The formula is: Inventory = Initial Inventory + Net Purchases.

Calculate COGS

Finally, COGS is determined by subtracting the ending inventory from the inventory of goods. It’s important to note that even without factoring in transport costs, returns, and discounts, COGS can still be calculated using the formula.

Example of Calculation of Cost of Goods Sold for a Trading Company:

A company that sells sports items that are completing their year-end financial statements and calculates the amount of inventory as in the following data:

Initial Inventory = $. 200,000

New purchase = $. 500,000,

Final Inventory = $ 100,000,

Solution:

COGS = Net Purchase + Initial Inventory – Final Inventory

COGS = $500,000, + $200,000, – $100,000 = $600,000,

So, the company sells its items for $600,000, this year, leaving only goods with a value of $100,000, on December 31.

This information not only helps the company plan purchases next year but will also help it evaluate its costs. This COGS can also provide information about sales margins for each item if classification is made for each item category. Thus, management can determine which products are the most profitable and make the most money.

How to calculate COGS at Manufacturing Companies?

Considering manufacturing companies are businesses that produce goods from raw materials, COGS must be calculated from how much raw material is used. The following stages are the parts of the calculation process:

Calculation of Raw Materials Used

Raw materials used can be calculated by adding up the number of raw materials at the beginning of the period by purchasing raw materials during the production process. Then, reduced by the final remaining raw material.

Calculating Other Production Costs

Other costs that also affect production are labor costs and overhead costs (raw material costs are not basic), such as costs for maintenance of equipment/repairs and electricity.

Calculate the Total Production Cost

To calculate all production costs, add up all the costs of raw materials used, labor costs, and overhead costs.

Calculating Cost of Production

Add the total cost of production to the inventory at the beginning of the production process, then deduct the inventory at the end of the production process.

Calculate Cost of Goods Sold

Finally, we calculate the finished goods of a manufacturing company is to add the cost of goods manufactured by the initial inventory and then subtract the final inventory.

Example of Calculation of Cost of Goods Sold for Manufacturing Companies

A company engaged in manufacturing vehicle parts has a raw material inventory of $2 million, semi-finished goods of $ 4 million, and supplies of Finished Goods ready to be sold for $5 million in early 2019. In the same year, the company purchased raw materials for $9 million with a shipping fee of $5 million. Labor and machine maintenance costs in 2019 are million. (https://www.sliderrevolution.com) At the end of 2019, the remaining use of raw materials is $1 million, the remaining inventory in the process of $1 million, and the remaining finished goods that can be sold are $3 million. What is the Cost of Sales or COGS of the company?

Initial Raw Material Inventory = $200,0000

Initial Processed Goods Inventory = 400,0000

Initial Finished Goods Inventory = 500,0000

Initial Material Purchase = 900,0000

Shipping Costs = 500,0000

Labor and Machine Maintenance Costs = 100,0000

Material Inventory Final Raw = 100,0000

Inventory of Processed Goods = 100,0000

Final Inventory = 300,0000

Solution

Calculation of Cost of Goods Sold for this case example must be calculated through four stages as mentioned before.

Stage I: Calculate the Raw Materials used

Raw Materials Used = Initial Raw Material Inventory + Purchase of Raw Materials – Final Raw Material Inventory Used Raw

Materials = 200,0000 + (900,0000 + 500,0000) – 100,0000

Used Raw Materials = 1500,0000

Stage II: Calculate the Total Production Costs

Total production costs = Raw materials used + direct labor costs + production overhead

costs Total production costs = 15000000 – 100,0000

Total production costs = 14000000

Stage III: Calculating Cost of Production

Cost of Production = Total cost of production + inventory of goods in the initial production process – supply of goods in the final production process

Cost of Production = 14000000 + 300,0000 – 100,0000

COP = 16000000

Stage IV: Calculate Cost of Goods Sold

COGS = Cost of goods manufactured + Initial inventory – inventory of finished goods

COGS = 16000000 + 400,0000 – 300,0000,

Cost of Goods Sold = 17000000

So the Cost of Manufacturing Companies is $ 17000000

Why is the calculation of the COGS Is Important?

There are three key reasons why calculating the cost of goods sold is important:

Record for tax purposes

COGS calculation is required for business taxes. Often, people overpay or pay no taxes because they don’t have a record of sales. To avoid this, you must have a record containing accurate invoices for sales made.

Track your profits

While running a business, you need to know how profitable your business is to determine if it’s worth staying in business. You won’t be able to calculate the profit without knowing how much your product or service costs you annually.

Future Overcast

When you track your cost of goods sold, you can look to the future and see which areas have potential development opportunities and which ones need to be improved or completely discontinued.

Cost of Goods Sold Example

Costs of goods sold are associated with certain goods that are calculated by various formulas, including first-in, first-out, or average cost. These costs may include all purchase costs, conversion costs, and other costs incurred in bringing inventories to their current status and condition. The costs of the goods made by the companies include material, labor, and general expenses that are assigned. Costs of those goods that are not yet sold differ as inventory costs until this inventory is sold or the value is recorded.

Example:

Source: overdraw.io

Calculation of the goods purchased, produced, sold, and inventory is necessary to determine the final profits.

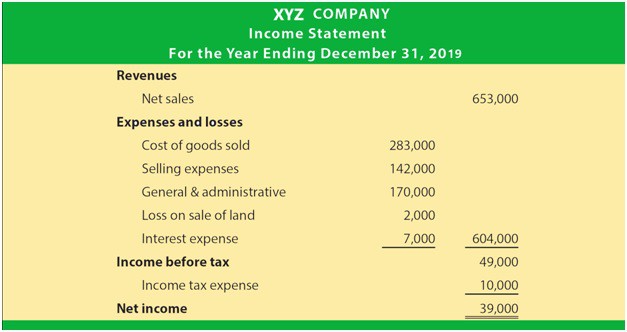

COGS in the financial statements

The cost of goods sold (COGS) is presented in the Income Statement. The COGS figure is used to calculate gross profit or gross income, and ultimately for the net profit or net income of the company within a given period. If COGS exceeds revenue within a certain period, then the company will not be able to generate a profit within that period. The primary objective of most companies is to generate profits that exceed their costs.

Two forms of financial statements for a business.

A company receives products either through purchases from retailers and distributors or through its own production as manufacturers. For retailers, the cost of the product is simply the cost of purchasing. This cost is recorded in the asset account and retained there until the sale of the products.

Similarly, as long as the business sells products, it incurs the cost of goods sold (COGS). When the company writes a check, it knows the exact amount it is for with no uncertainty about the cost. However, when a company withdraws products from its inventory and records the cost of goods sold, the amount of costs incurred can vary depending on the accounting method the company chooses.

The cost of goods sold in the income statement

The basic structure of the income statement is as follows:

| Income Statement | Example |

|---|---|

| Net Income or Sales | $10,000 |

| Direct Cost of Goods Sold | $5,000 |

| Gross Margin | $5,000 |

| – General Labour and Administrative Expense | – $2,000 |

| EBITDA | $3,000 |

| – Amortization and provisions expenses | $500 |

| Profit before interest and taxes | $2,500 |

| Extraordinary income | $1,000 |

| Extraordinary expenses | – $2,000 |

| Ordinary result | $1,500 |

| Financial Income | $2,000 |

| Financial Expense | – $3,000 |

| Profit before tax (BAT) or EBT | $500 |

| Corporation tax | $300 |

| NET PROFIT OR PROFIT FOR THE YEAR | $200 |

Besides, some more intermediate steps can be added. For example, if the company has discontinued operations, the profit after deducting taxes would be called the profit from continued operations. Combining the result of discontinued operations would obtain the net profit.

What is the difference between the cost of goods sold and purchasing?

“The income statement includes the cost of goods sold, not the purchase.

The cost of goods sold represents the cost related to each item sold. It comprises the total purchase amount of the products sold, even if they were purchased in a previous year but sold in the current year.

On the other hand, the purchase amount refers to the total amount of goods purchased within a specific year.

The cost of sales is obtained by subtracting the purchase amount of sales for the current year from the cumulative purchase amount up to that point.

What items are included in the Cost Of Goods Sold?

The COGS includes the direct cost of producing the product or the wholesale price of the goods resold and the direct costs of labor to deliver the product. Specifically, it may include:

- The cost of raw material for the manufacturing of the item;

- Labor cost;

- Cost of electricity;

- Cost of depreciation of machinery;

- The maintenance cost of these machines;

- Freight cost

- Product packaging cost.

These are all the efforts required to produce the product that will be sold.

Each company will have different types of expenditures. Some will need more investment in labor, while others in raw materials.

Nevertheless, all expenses involved in this production must be calculated, from the smallest to the largest.

Is the Cost Of Goods Sold an asset or a liability?

The truth is that COGS is a calculation that yields results without necessarily quantifying the amount of product or raw material. Additionally, this indicator typically does not appear on the balance sheet.

On the other hand, inventory is usually included in the report and classified as an asset.

Based on the concept that assets indicate the company’s income and earnings, it is possible to understand COGS as a calculation of assets, as it presents the gross profit from sales.

Related Articles: