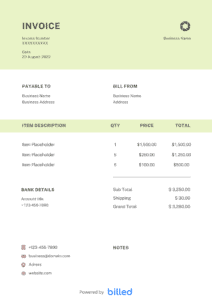

Accounting Invoice Template

Streamline your entire billing process with this free and customizable Accounting Invoice Template. This beautiful template is designed to help you easily create a professional-looking and detailed invoice in just a few seconds.

Get Your Free Accounting Invoice Template

As a professional accountant, you manage bookkeeping, interpreting financial information, and prepare financial documents for your clients.

But you might be struggling to run your own business effectively, especially in the areas of billing and payment collection.

Our free downloadable high-quality invoice templates help you create professional-looking and detailed invoices quickly in the right way.

You can download the templates in your favorite format like Google Sheets, Google Docs, PDF, Word, Excel.

Download Accounting Invoice Templates

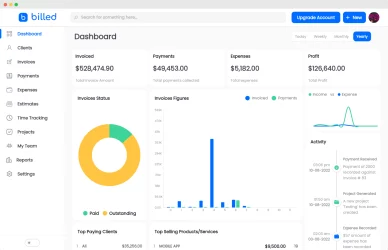

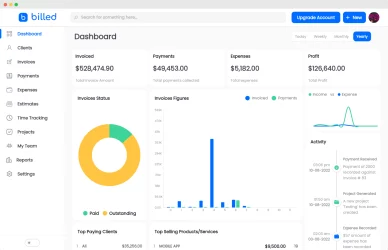

Invoice With Billed

Accept online payments on your invoices to get paid faster.

Invoice With Billed

Accept online payments on your invoices to get paid faster.

- What Is an Accounting Invoice Used For?

- Why Should Accountants Send Professional Invoices?

- When Is The Right Time To Send An Invoice As An Accountant?

- Who Can Use Accounting Invoice?

-

Invoicing Tips For Accountants

- Invoice Types For Accountants

- Some Other Templates

- How To Create An Accounting Invoice?

- Download An Accountanting Invoice Template For Free

What Is an Accounting Invoice Used For?

An accounting invoice requests payment from a client for services rendered or products sold by an accountant. It serves as a formal document that outlines the details of the transaction, including the description of the services or products, quantities, rates, subtotals, taxes, and the total amount due.

For example, an accountant may invoice a client to prepare their yearly financial statements and tax returns. The invoice would include the breakdown of services provided, the associated fees, and the payment terms. The client refers to the invoice to review and process the payment, while the accountant uses it for record-keeping and financial management purposes.

Why should accountants send professional invoices?

Playing with numbers is one of many things that accountants do. They also need to send professional invoices and process payments from their clients.

With a high-quality invoice template, you can ensure that your invoices are accurate and presentable. This is important because it gives your client the necessary information to ensure they are paying you correctly for services rendered. It also makes them feel more secure about your services as a professional accountant.

By using an invoice template, you can also save time creating invoices, which means more time to focus on other important tasks. This will help streamline your billing process and increase efficiency in your accounting practice.

When is the right time to send an invoice as an accountant?

As an accountant, sending an invoice at the right time is crucial to maintain a positive relationship with your clients and ensure prompt payment. Timing can vary depending on the specific agreement or project. For example, if you’ve just completed a tax consultation for a client, seize the opportunity by promptly sending the invoice while the value of your services is fresh in their mind.

This demonstrates your professionalism and dedication to providing quality service. Sending the invoice promptly demonstrates efficiency and encourages timely payment from the client, maintaining a strong collaborative momentum.

Who Can Use Accounting Invoice?

Anyone who provides accounting services or sells accounting-related products can use an accounting invoice. This includes:

- Accountants

- Accounting firms

- Bookkeepers

- Financial consultants

- Tax advisors

- Auditors

- Companies selling accounting-related products or services.

These individuals or entities utilize accounting invoices to bill clients or customers for their services, products, or expertise in accounting.

Invoicing tips for accountants

With these tips, you can not only bill your clients easily but also collect your payments ideally and precisely.

Include professional recommendations: Along with the invoice, provide value-added recommendations or insights related to the client’s financial situation. This shows your expertise and dedication to their financial success. For example, if you notice potential tax savings opportunities, include a brief note highlighting those suggestions. This enhances your value to the client and reinforces their trust in your services.

Keep a record of your work with numbered invoices: Assign unique invoice numbers to each transaction and maintain a systematic record of your invoices. Numbered invoices help you stay organized and provide a reference for you and your clients. This facilitates easy tracking, improves accountability, and simplifies reconciliation processes.

Accept various payment methods: Offer multiple payment options to make it easy for customers to pay. Accepting bank transfers, credit cards, and online payment platforms widens the accessibility for clients and expedites the payment process. Communicate the accepted payment methods on your invoices to ensure clients can choose the most convenient option.

Clearly outline payment terms: State the payment terms, including the due date, on each invoice. Use simple and precise language to avoid any confusion. For instance, specify whether the payment is due upon receipt or within a specific timeframe. This clarity helps clients understand their obligations and reduces the likelihood of late payments.

Follow up on overdue payments: Maintain regular communication with clients and promptly follow up on overdue payments. Send polite reminders or make phone calls to inquire about the payment status. Regularly monitoring outstanding invoices helps improve cash flow and minimizes any potential financial strains on your business. This proactive approach demonstrates your professionalism and commitment to financial integrity.

Invoice Types for Accountants

Invoices play a very important role to get paid promptly and ideally, so you can not ignore the importance of invoices. For your easement Billed facilitates you with various types of the invoice so that you could quickly receive the reward of your hard work in the right way.

Here are some key invoice types for accountants:

Standard Invoice:

This is the most typical type of invoice used by accountants. It includes the client’s name, address, invoice number, services rendered, quantities, rates, subtotals, taxes, and the total amount due. Standard invoices are typically used to bill clients for services provided or products sold.

Recurring Invoice:

Accountants often retain clients or provide ongoing services at regular intervals, like monthly or quarterly. Recurring invoices are generated automatically and sent to clients on a predetermined schedule. These invoices are time-saving and efficient as they remove the requirement for manual creation and sending of invoices for recurring services.

Proforma Invoice:

A proforma invoice is a preliminary document provided to clients before the invoice. It outlines the estimated costs of services or products, including any applicable taxes or discounts. Proforma invoices are commonly used when the final details of a project or engagement still need to be finalized. They serve as a way to provide cost estimates and obtain client approval before proceeding with the work.

Credit Memo:

Credit memos help maintain accurate financial records and ensure that clients are charged correctly. A credit memo is issued by accountants when they need to adjust the client’s invoice due to discounts, returns, or errors in the original invoice. It reflects a credit or reduction in the amount owed by the client.

Prepayment or Deposit Invoice:

Accountants may request client prepayment or deposits before providing services or starting a project. Prepayment invoices outline the agreed-upon amount and serve as a record of the client’s advance payment. These invoices help ensure that both parties are clear on the financial arrangement and provide a reference for the future reconciliation of payments.

Progress or Milestone Invoice:

For long-term projects or engagements, accountants may use progress or milestone invoices to bill clients at different stages of completion. These invoices reflect the portion of work completed and the corresponding payment due. Progress or milestone invoices help manage cash flow and maintain transparency with clients throughout the project duration.

Retainer Invoice:

Accountants who offer ongoing services to clients may use retainer invoices. These invoices outline the agreed-upon retainer fee for a specific period. Retainer invoices are often generated on a recurring basis and ensure that clients pay in advance for a set amount of services.

How to create an invoice?

You might get confused while creating an invoice to bill your clients, but with Billed you can easily create a well-organized and detailed invoice in a minute.

Follow the given steps and get your professional and crystal clear invoice before long.

- Download the Free Accounting Invoice Template from Billed

- Add your or business name, contact details like phone number, email address, etc.

- Add your logo in different fonts and colors

- Add your client’s name and contact details

- Add the invoice issuance date

- Add the payment due date

- Enter the unique invoice number

- Add the list of your services rendered and cost for each

- Calculate the total cost of the project, including tax, etc.

- Insert payment terms and conditions

- Add privacy policy if any

- Save

- Send via Billed or email, etc.

The clients always respond to detailed and easy-to-readable invoices. With Billed you can easily start collecting your payments timely and flawlessly.

Download an Accounting Invoice Template for Free

Now you can download the free accounting invoice template from Billed .io. This beautiful template is easy to customize and ready for use in your business. Download now and get started with efficient invoicing today!