Billing Invoice Template

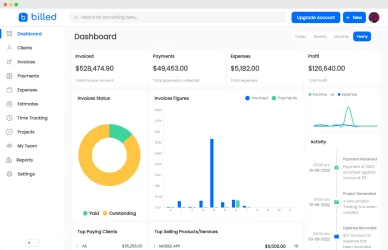

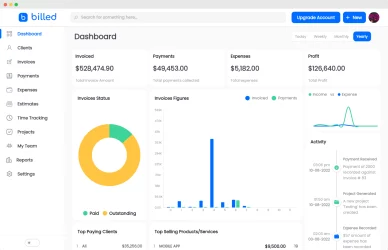

Download the free billing invoice template from Billed and simplify your invoicing process. With this user-friendly template, you can create professional invoices that ensure accurate billing and prompt payments. Take control of your finances and download the template today.

Get Your Free Billing Invoice Template

Whether you provide specialized services or have sales of products, you want to receive all your payments from those sales or services at the end of the day.

Get free billing invoice templates from Billed, create the ideal and perfect invoices in a minute, and get paid for your services or products promptly and ideally.

Our stylish and free downloadable invoice templates are available in various friendly formats like Google Sheets, Google Docs, PDF, Word, Excel. Visit our templates gallery.

Download Billing Invoice Templates

Handy tips for small businesspersons

Without a professional and detailed invoice, it could be challenging to get paid immediately and ideally. Here are some main invoicing tips that help you to create a professional and productive invoice.

Numbered the invoice: It helps you to identify every invoice. Through invoice numbers, you can easily keep track of all invoices effortlessly.

Include a ‘payment due’ date: Including the payment due date in the invoice helps your client know when you expect to get paid.

Include up-to-date contact information: After entering the contact information in the invoice, it is better to recheck it. Wrong contact details can cause a delay.

Accept a variety of payment methods: The flexibility in payment methods enables you to receive your payments as soon as possible.

What Is a Billing Invoice Used For?

A billing invoice is a document used to record the sale of goods or services and to request payment from customers. The invoice serves as evidence of a transaction. It includes essential information like the customer’s name, date of purchase, amount due, description of services/products purchased, and payment terms. Invoices are generally sent after the purchase has been made, but in some cases may be sent in advance with an estimate of the total cost. Billing invoices can also be used to track payments and any discounts offered.

Why should small business owners send professional invoices?

Small business owners should send professional invoices to ensure accurate billing and prompt payments. Professional invoices provide customers with detailed information about the transaction, making it easier to track payments and avoid any issues. Additionally, sending professionally designed invoices can help strengthen a business’s brand image by creating a more polished look. Professional invoices also help keep financial records organized for easy access when needed.

When to send the billing invoices?

The timing of sending billing invoices may vary depending on the business and the agreement with the client. Here are a few common scenarios:

Upon Completion: Sending the invoice immediately after completing the project or delivering the products is a common practice. This ensures the client receives the invoice promptly and can process the payment without delay.

Milestone-Based: For long-term projects or projects with multiple stages, sending invoices at specific milestones may be appropriate. This approach allows for partial payments throughout the project’s duration, ensuring a steady cash flow for the business.

Recurring Billing: If the business provides recurring services or products regularly, invoices can be sent at predetermined intervals (e.g., monthly, quarterly, annually). This streamlines the billing process and helps establish a consistent payment schedule.

Upfront Deposits or Retainers: In some instances, businesses may require upfront deposits or retainers before starting a project. In such cases, the invoice should be sent before commencing the work to secure the necessary payment and initiate the project.

Subscription-Based Services: For businesses offering subscription-based services, invoices are typically sent according to the agreed-upon billing cycle (e.g., monthly, annually). It is important to send invoices on time, ensuring clients have sufficient notice before the next payment is due.

Invoice Types for Small Businesses

Small businesses typically use different types of invoices to suit their specific needs. Here are a few common invoice types:

Standard Invoice: This is the most basic type of invoice, providing a detailed breakdown of products or services rendered and the related costs. It includes essential information such as the business name, client details, invoice number, payment terms, and due date.

Recurring Invoice: Small businesses that offer subscription-based services or have recurring billing arrangements use recurring invoices. These invoices are generated automatically at regular intervals (e.g., monthly or quarterly) and include the predetermined charges for ongoing services.

Proforma Invoice: A proforma invoice serves as a preliminary document issued before a project’s final sale or completion. It summarizes the estimated costs and terms, allowing clients to review and approve before proceeding with the actual transaction.

Credit Invoice: A credit invoice is used if a small business needs to issue a refund or credit to a client. This type of invoice negates or subtracts the amount owed from the client’s account, indicating a reduction in the overall balance.

Past Due Invoice: When a client fails to make payment by the due date, a past due invoice is sent as a reminder. It highlights the outstanding balance and includes a note emphasizing the urgency of payment.

Deposit Invoice: A deposit invoice is used for projects requiring an upfront payment or a deposit. It specifies the amount due as a deposit, outlining the terms and conditions regarding the remaining payment upon completion.

How To Create A Billing Invoice?

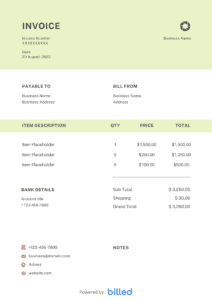

Creating an accurate and detailed billing invoice with our template is straightforward. Follow these steps to create a billing invoice:

Download the template: Get the free billing invoice template from Billed.

Add company details: Include your business name, logo, address, cell number, email address, and other relevant information at the top of the invoice.

Enter client details: Input the client’s name, address, and other necessary contact information below your company details. Double-check the accuracy of the client’s information.

Assign an invoice number: Generate a unique invoice number for this billing invoice. Place the invoice number prominently on the invoice for easy reference.

Invoice issue and due date: Specify the date when the billing invoice is issued and indicate the payment due date. This provides a clear timeline for the client to make the payment.

Line items: List the services or products provided as separate line items. Include each line item’s description, quantity, rate, and subtotal. This breakdown helps the client understand the specifics of the billing invoice.

Subtotals and taxes: Calculate the subtotal by adding the line item totals. If applicable, include any taxes or additional charges to provide a comprehensive overview of the costs.

Total amount: Calculate the amount due by adding the subtotal and any taxes or additional charges. Display this total prominently on the billing invoice to indicate the final payment required.

Payment terms and conditions: Specify the payment terms and conditions, such as accepted payment methods, any applicable discounts, and late payment penalties. Include this information in a separate section or at the bottom of the billing invoice.

Save and send: Save the completed billing invoice with an appropriate file name for easy retrieval. If sending electronically, attach the invoice to an email and send it. Alternatively, you can print the billing invoice and mail it to the client if desired.

With our stylish and flexible billing invoice template, you can quickly fill in all the details of your services and help you to bill your clients in a minute and get the reward immediately in the right way.

Download a Billing Invoice Template for Free

Start streamlining your billing process with the free billing invoice template available for download from Billed today. Our template combines beauty and functionality, allowing you to customize it according to your business needs. Simplify your invoicing and create professional invoices effortlessly with our user-friendly template.